Strive to unlock your student loan refund?

Editor's Notes: Unlock Your Student Loan Refund: A Comprehensive Guide To Maximizing Your Return has published today, date. This topic important to read because some student loan companies are required to refund you some of the money you've paid toward your student loans if you've made payments during the COVID-19 federal student loan payment pause. In few cases, the refund can be as high as $10,000.

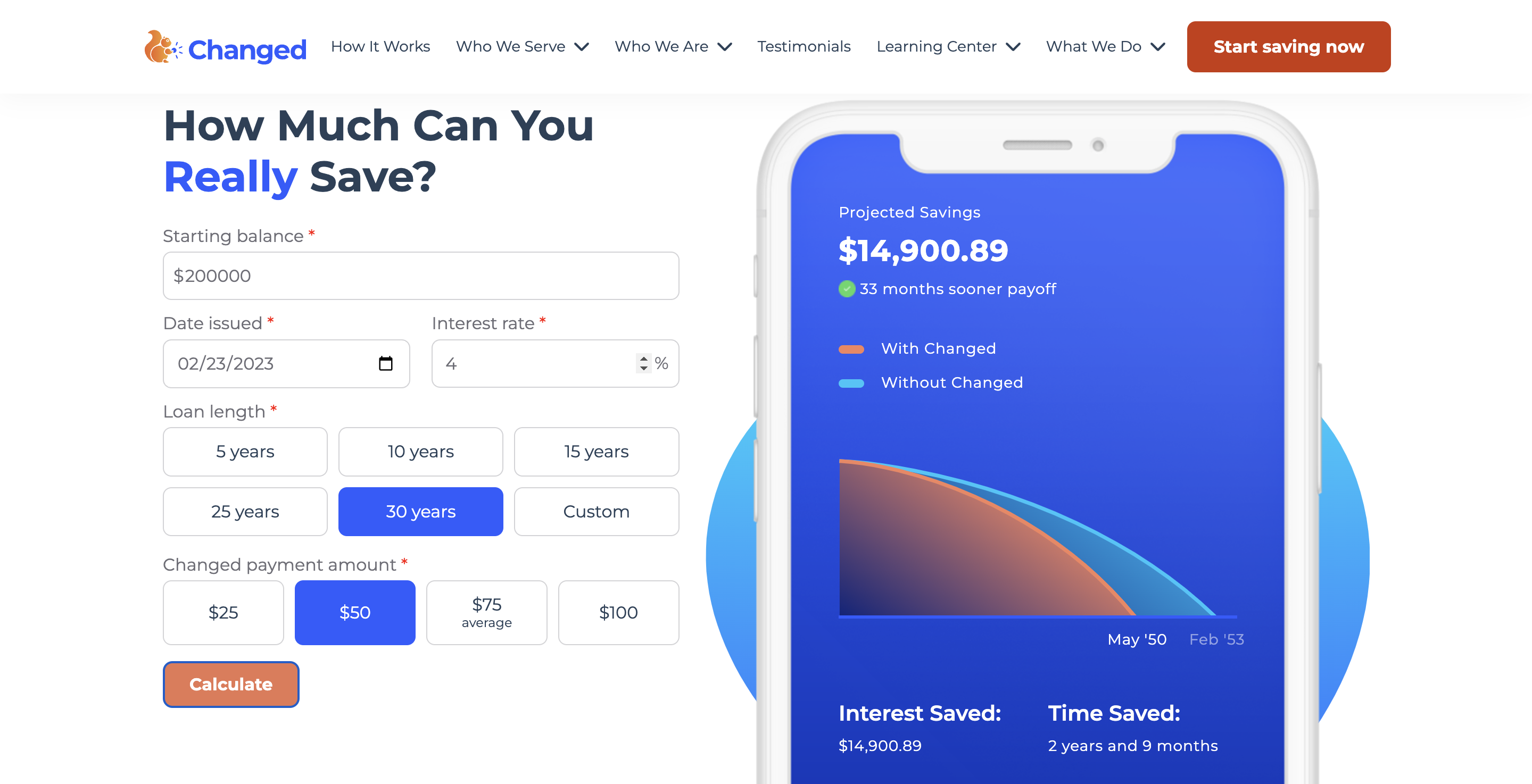

Crush Your Debt with Just an Extra a Month - Source www.gochanged.com

To help you make the right decision, we put together this Unlock Your Student Loan Refund: A Comprehensive Guide To Maximizing Your Return guide after some analysis and digging information.

| Key Differences | Key Takeaways |

|---|---|

| Qualifying for a refund | You may be eligible for a refund if you made payments on your federal student loans during the COVID-19 federal student loan payment pause, which began March 13, 2020, and ended Dec. 31, 2022. You can get a refund of the entire amount you paid since March 13, 2020, even if you've already made payments on your loans. |

| Requesting a refund | It is important to put request for refund before the April 2023 deadline

. |

Read the main article topics:

FAQ

This FAQ section provides answers to frequently asked questions regarding maximizing student loan refunds. Refer to our comprehensive guide Unlock Your Student Loan Refund: A Comprehensive Guide To Maximizing Your Return for more detailed information.

Question 1: Is there eligibility criteria for student loan refunds?

Eligibility for a student loan refund depends on specific circumstances. Typically, students who receive financial aid in excess of their educational expenses may qualify. Additionally, those who withdraw from school or receive a closed school discharge may also be eligible.

Question 2: What are the steps to request a student loan refund?

The process of requesting a student loan refund varies depending on the lender and loan servicer. Generally, students must contact their loan servicer, provide relevant documentation such as enrollment verification or proof of withdrawal, and follow the instructions provided by the servicer.

Question 3: How long does it typically take to receive a student loan refund?

The processing time for student loan refunds varies. Some refunds may be received within a few weeks, while others may take several months. Factors such as the number of refunds being processed and the complexity of the individual's situation can affect the timeline.

Question 4: Can I receive a refund for student loans that are in repayment?

Yes, it is possible to receive a refund for student loans that are in repayment. However, the amount of the refund may be limited based on the amount that has already been repaid. Additionally, any refunded funds will be applied to the outstanding loan balance, reducing future payments.

Question 5: Are there any tax implications for receiving a student loan refund?

Tax implications vary depending on individual circumstances. Generally, refunds received for expenses that were previously claimed as tax deductions may need to be reported as income. It is recommended to consult with a tax professional for specific guidance.

Question 6: Where can I get additional assistance with student loan refund matters?

The U.S. Department of Education provides resources and support for student loan borrowers. Students can also contact their loan servicer or seek professional advice from a financial advisor or student loan counselor.

By understanding the eligibility criteria, process, and potential implications of requesting a student loan refund, you can effectively utilize this option to manage your educational expenses.

Next, we'll explore strategies for minimizing student loan debt through repayment options and consolidation.

Tips

Explore avenues to potentially recover unused funds from student loans, maximizing the return on educational investments.

Tip 1: Review Loan Statements and Contact Servicers:

Regularly examine loan statements for overpayments, potential refunds, or errors. If discrepancies arise, promptly contact the loan servicer for clarification and potential resolution.

Tip 2: Check for Stimulus Payments and Tax Refunds:

Federal stimulus payments and tax refunds can be applied to outstanding student loan balances. Verify eligibility and track payments to ensure proper allocation.

Tip 3: Explore Loan Consolidation and Refinancing:

Consolidation combines multiple loans into a single, potentially lower-interest loan, while refinancing replaces existing loans with new ones at more favorable terms. Explore options to reduce interest charges and accelerate repayment.

Tip 4: Consider Income-Driven Repayment Plans:

Income-driven repayment plans adjust monthly payments based on income, potentially reducing strain on finances while allowing for progress on loan repayment.

Tip 5: Utilize Public Service Loan Forgiveness:

Employees in qualifying public service roles may be eligible for loan forgiveness after 10 years of consistent payments under certain conditions. Explore eligibility requirements and explore this potential benefit.

Summary:

By following these tips, individuals can enhance their understanding of student loan management, potentially recover excess funds, and optimize financial outcomes. Thorough research and proactive communication with loan servicers are key to maximizing the return on student loan investments.

Unlock Your Student Loan Refund: A Comprehensive Guide To Maximizing Your Return

Understanding the key aspects of student loan refunds is crucial for maximizing your return. These aspects encompass eligibility criteria, repayment plans, tax implications, consolidation options, forgiveness programs, and dispute resolution procedures.

- Eligibility Criteria: Determine if you qualify for a refund based on overpayments or loan forgiveness programs.

- Repayment Plans: Explore different repayment plans to adjust monthly payments and potential refund amounts.

- Tax Implications: Understand the tax consequences of student loan refunds, including potential income tax liability.

- Consolidation Options: Consider consolidating multiple loans to simplify repayment and potentially qualify for refunds.

- Forgiveness Programs: Research loan forgiveness programs that may discharge remaining loan balances and provide refunds for overpayments.

- Dispute Resolution: Learn about the process for disputing errors or discrepancies related to student loan refund calculations.

These aspects are interconnected and impact the overall refund amount and repayment experience. For instance, consolidating loans may simplify repayment, but could affect eligibility for certain forgiveness programs. Understanding the tax implications of refunds helps in planning for potential additional tax liability. By navigating these key aspects effectively, you can maximize your student loan refund, reduce repayment burden, and achieve financial well-being.

Student loan debt forgiveness survives another court challenge. - Source www.usatoday.com

Unlock Your Student Loan Refund: A Comprehensive Guide To Maximizing Your Return

Understanding student loan refunds is essential for borrowers seeking to optimize their financial situation. Federal student loan borrowers who have made payments during the pandemic may be eligible for a refund under the CARES Act, which paused federal student loan payments and set the interest rate to 0%. This guide provides comprehensive information on identifying eligibility, calculating the potential refund amount, and navigating the application process.

How does a 1098-E affect my taxes? Leia aqui: Does filing a 1098-E - Source fabalabse.com

Borrowers who have made payments toward their federal student loans during the payment pause are eligible for a refund. The amount of the refund is equal to the amount paid during the suspension period, including principal, interest, and late fees. Additionally, borrowers may be eligible for a refund of any fees associated with the loans, such as origination fees or application fees.

To apply for a refund, borrowers should contact their loan servicer. The servicer will provide instructions on how to submit the request and may require documentation to verify the amount of payments made during the payment pause.

Obtaining a student loan refund can have a significant impact on a borrower's financial situation. The funds can be used to pay down other debts, save for the future, or cover unexpected expenses. Additionally, receiving a refund can provide borrowers with a sense of relief and control over their student loan debt.

| Benefits of Student Loan Refunds | Challenges of Student Loan Refunds | |

|---|---|---|

| Reduced debt burden | Application process can be time-consuming | |

| Improved financial flexibility | May not be available for all borrowers | |

| Reduced stress and anxiety | Can be difficult to navigate |

Conclusion

Unlocking student loan refunds is a valuable opportunity for borrowers to improve their financial well-being. By understanding the eligibility criteria and application process, borrowers can maximize their refund and take control of their student loan debt. This guide provides comprehensive information to assist borrowers in navigating the complexities of student loan refunds and achieving financial success.

While obtaining a refund can be beneficial, it is important for borrowers to consider their individual circumstances and make informed decisions. Borrowers should weigh the potential benefits against any potential drawbacks before applying for a refund.