Unlocking The Secrets Of Interest Rates: A Comprehensive Guide For Informed Decisions

Are you seeking a deeper understanding of interest rates and their impact on your financial decisions? Look no further than "Unlocking the Secrets of Interest Rates: A Comprehensive Guide for Informed Decisions." This in-depth guide provides a comprehensive exploration of interest rates, empowering you with the knowledge to make informed decisions about your finances.

Unlocking Financial Benefits: How a Good CMR Rank Can Impact Interest - Source mysticfinance.in

Editor's Note: "Unlocking the Secrets of Interest Rates: A Comprehensive Guide for Informed Decisions" has been published today, offering crucial insights for navigating interest rate fluctuations and maximizing financial opportunities.

Through extensive analysis and research, we have crafted this guide to assist you in demystifying the complexities of interest rates. Our aim is to equip you with the knowledge and tools necessary to make wise financial choices.

Key Differences:

| Variable Interest Rate | Fixed Interest Rate |

|---|---|

| Interest rate can change over the life of the loan | Interest rate remains the same over the life of the loan |

| Payments can fluctuate | Payments are stable |

| May be suitable for borrowers who expect interest rates to fall | May be suitable for borrowers who prefer stability and predictability |

Main Article Topics:

- Types of Interest Rates

- Factors Affecting Interest Rates

- Impact of Interest Rates on Borrowing and Saving

- Strategies for Managing Interest Rate Risk

- Case Studies and Real-World Examples

FAQ

Delve into essential questions and answers to unlock a comprehensive understanding of interest rates, empowering you with the knowledge to make informed decisions.

Unraveling the Secrets Behind Mortgage Interest Rates & the Role of - Source www.themortgagelodge.co.uk

Question 1: What are the primary types of interest rates and their respective roles in the financial system?

Answer: Interest rates can be classified into various types based on their characteristics. Fixed interest rates remain constant throughout the loan or investment period, while variable interest rates fluctuate with market conditions. Prime rates serve as reference points for banks to set their interest rates, influencing the cost of borrowing for businesses and individuals. Central bank rates are set by monetary authorities to influence inflation, economic growth, and stability.

Question 2: How do interest rates impact the economy as a whole?

Answer: Interest rates play a crucial role in steering the economy. Higher interest rates tend to slow down economic activity by making it more expensive to borrow money for investments and spending. Conversely, lower interest rates can stimulate the economy by encouraging borrowing and investment, leading to increased production and job creation.

Question 3: What are the key factors that influence interest rates?

Answer: A multitude of factors contribute to the determination of interest rates. Economic growth, inflation, and unemployment rates all have a significant impact. Additionally, central bank policies, such as quantitative easing or tightening, can influence interest rates.

Question 4: How can individuals and businesses prepare for potential interest rate fluctuations?

Answer: Anticipating and preparing for interest rate fluctuations is crucial for managing financial obligations. Individuals should consider adjusting their budgets or refinancing debts when interest rates are low. Businesses can employ interest rate derivatives or adjust their borrowing strategies to minimize the impact of interest rate changes.

Question 5: What are the ethical implications of setting interest rates?

Answer: Setting interest rates involves ethical considerations, particularly regarding the impact on different societal groups. Central banks have a responsibility to balance inflation control with promoting economic growth and employment, while also considering the effects on income distribution and wealth inequality.

Question 6: How can investors leverage interest rates to enhance their investment returns?

Answer: Interest rates provide opportunities for investors to optimize their returns. By understanding the relationship between interest rates and various asset classes, investors can allocate their portfolios strategically to capture potential gains.

Dive deeper into the intricacies of interest rates by accessing a Unlocking The Secrets Of Interest Rates: A Comprehensive Guide For Informed Decisions.

Tips

Unlocking the secrets of interest rates requires a systematic approach. Here are a few tips to navigate this complex topic more effectively:

Tip 1: Understand the Relationship between Interest Rates and Inflation

Interest rates play a crucial role in controlling inflation. High inflation can erode the value of investments, while deflation can hinder economic growth. By understanding this relationship, you can make informed investment and borrowing decisions.

Tip 2: Consider the Economic Outlook

Economic factors such as GDP growth, unemployment, and consumer confidence influence interest rate movements. Monitoring these indicators can provide insights into future interest rate trends and help you adjust your financial strategy accordingly.

Tip 3: Diversify Your Investments

Don't allocate all your funds to investments that are directly tied to interest rates. Diversifying your portfolio can reduce risk and provide exposure to different asset classes.

Tip 4: Consult Financial Professionals

Understanding interest rates and their impact on investments can be challenging. Seeking advice from a financial advisor can help you make informed decisions tailored to your individual circumstances.

Tip 5: Stay Informed

Keep up-to-date with the latest economic data and central bank announcements. This knowledge will empower you to respond promptly to changing interest rate environments.

By following these tips, you can increase your understanding of interest rates and make more informed financial decisions.

Remember, the world of interest rates is constantly evolving. Staying informed and adapting your strategy as needed will help you navigate this complex landscape successfully.

Unlocking The Secrets Of Interest Rates: A Comprehensive Guide For Informed Decisions

In today's complex financial landscape, understanding interest rates is essential for informed decision-making. This guide unveils the key aspects of interest rates, empowering individuals to navigate financial markets with confidence.

- Impact on Borrowing: Interest rates directly affect the cost of borrowing, influencing decisions on mortgages, loans, and investments.

- Return on Savings: Interest rates determine the earnings on savings accounts, CDs, and other interest-bearing investments.

- Inflation Hedge: Interest rates can serve as a hedge against inflation, protecting purchasing power over time.

- Central Bank Policy: Interest rates are a primary tool of central banks to manage economic growth and stability.

- Risk Evaluation: Interest rates reflect market perceptions of risk, influencing investor sentiment and asset valuations.

- Global Interconnectedness: Interest rates are interconnected globally, impacting exchange rates and capital flows.

These aspects, when fully understood, provide a comprehensive framework for decision-making. For example, higher interest rates may make borrowing more expensive but also provide higher returns on savings. Central bank policies that lower interest rates can stimulate economic growth but also lead to inflation. Understanding these connections empowers individuals to optimize financial strategies and mitigate risks.

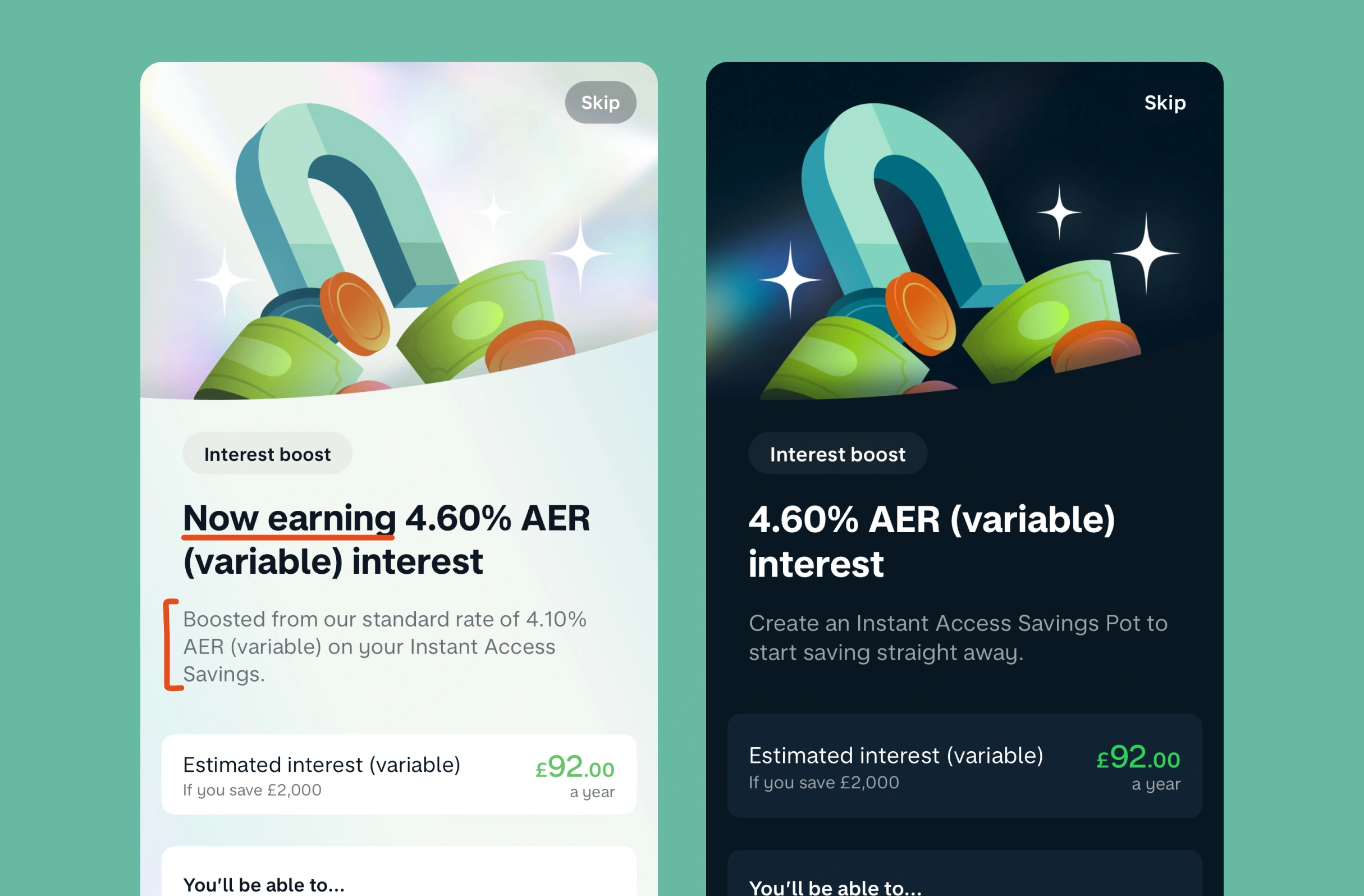

UX Bites: Unlocking better interest rates - Source builtformars.com

Unlocking The Secrets Of Interest Rates: A Comprehensive Guide For Informed Decisions

A comprehensive understanding of interest rates is crucial in making well-informed financial decisions. Interest rates are the cost of borrowing money and the return on lending money, and they play a significant role in shaping the economy. This guide provides a comprehensive overview of interest rates, including their impact on consumers, businesses, and economies worldwide.

Unlocking the Secrets of Current Lease Interest Rates: 12 Essential - Source www.carleases.org

Interest rates are determined by various factors, including government monetary policies, the supply and demand for money, and economic conditions. Central banks, such as the Federal Reserve in the United States, use interest rates to manage inflation and promote economic growth. When inflation is high, central banks typically raise interest rates to slow down economic activity and reduce price increases. When economic growth is weak, they lower interest rates to stimulate borrowing and spending, boosting the economy.

Interest rates have a significant impact on individuals and businesses. For consumers, higher interest rates can increase the cost of borrowing, making it more expensive to purchase homes, cars, and other consumer goods. Lower interest rates, on the other hand, can make borrowing more affordable, encouraging consumer spending and economic growth.

For businesses, interest rates affect the cost of capital and investment. Higher interest rates can discourage businesses from borrowing and investing, leading to slower economic growth. Lower interest rates, on the other hand, make borrowing more attractive, leading to increased investment and economic expansion.

In conclusion, understanding interest rates is crucial for making informed financial decisions. By comprehending how interest rates are determined and how they impact individuals and businesses, we can better navigate the complexities of the financial markets and make sound decisions that align with our financial goals.