Ensuring your vehicle is registered and taxed is essential for legal driving and avoiding penalties. Today, numerous regions facilitate the convenient online payment of road taxes, offering significant benefits for vehicle owners.

Editor's Notes: "Pay Your Road Tax Online For Seamless Vehicle Registration And Tax Management" have published today date". Give a reason why this topic important to read.

Our comprehensive analysis and diligent research have culminated in this guide to empower vehicle owners with the knowledge they need to make informed decisions regarding online road tax payments. We delve into the advantages and key considerations to ensure seamless vehicle registration and tax management.

| Before Online Road Tax Services | With Online Road Tax Services |

|---|---|

| Long queues at tax offices | Convenience of paying taxes from anywhere, anytime |

| Time-consuming process | Quick and efficient tax payment |

| Risk of errors due to manual processing | Automated systems reduce errors and streamline the process |

...

FAQ

The digitalization of vehicle registration and tax management services has streamlined the process, making it more efficient and convenient for citizens. Pay Your Road Tax Online For Seamless Vehicle Registration And Tax Management without any hassle.

Vehicle Registration Tax Process | Full Guide & Helpful Resources - Source www.vrt.ie

Question 1: What are the benefits of online road tax payment?

Answer: Online road tax payment offers several benefits. These include the convenience of making payments from anywhere, anytime, reduced paperwork, faster processing times, and the availability of secure payment gateways.

Question 2: Is it mandatory to pay road tax online?

Answer: While it may not be mandatory in some jurisdictions, the convenience and efficiency of online road tax payment make it highly recommended. It is generally the preferred method for vehicle owners.

Question 3: What documents are required for online road tax payment?

Answer: The documents typically required for online road tax payment are vehicle registration, insurance policy number, owner's identification, and a valid payment instrument

Question 4: What are the payment options available for online road tax payment?

Answer: Most online road tax payment services offer multiple payment options for convenience. These may include credit cards, debit cards, net banking, and e-wallets.

Question 5: Is it safe to make online road tax payments?

Answer: Yes. Reputable online road tax payment platforms prioritize security. They typically use secure payment gateways, encrypt sensitive information, and comply with data protection standards.

Question 6: Can I track the status of my online road tax payment?

Answer: Most online road tax payment platforms provide real-time updates or email notifications on the status of your payment. This allows you to track the progress and ensure timely updates on your vehicle's registration and tax status.

Remember to check official sources or reputable third-party platforms when making online road tax payments. By following these guidelines, you can ensure a smooth and hassle-free experience.

Consider exploring other articles on road safety, vehicle maintenance, and other topics relevant to vehicle ownership to enhance your knowledge and ensure a safer and more enjoyable driving experience.

Tips for Seamless Vehicle Registration and Tax Management

Ensure up-to-date vehicle information and avoid penalties by adhering to the following guidelines for online payment of road tax:

Tip 1: Gather Necessary Documents: Before initiating the online payment process, ensure you have the vehicle registration certificate, insurance certificate, and other relevant documents readily available.

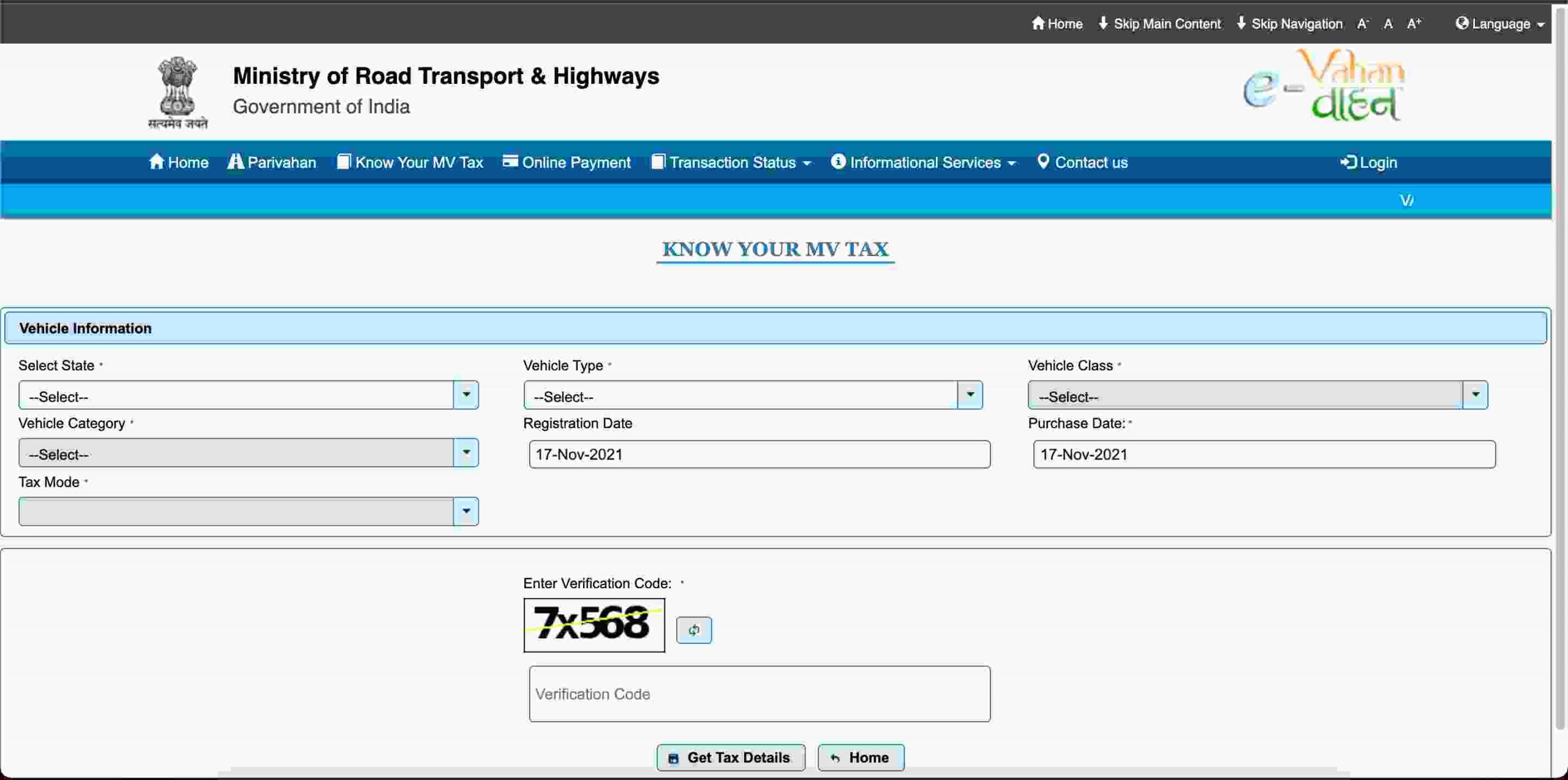

Tip 2: Confirm Vehicle Details: Carefully review the vehicle information on the government website or mobile application. Verify the accuracy of the details, such as vehicle model, engine number, chassis number, and current registration status.

Tip 3: Calculate Tax Amount: Determine the applicable road tax amount based on your vehicle type, engine capacity, and other factors. Refer to the official guidelines or use the online tax calculators provided by the government.

Tip 4: Choose Payment Method: Opt for a secure and convenient payment method, such as credit card, debit card, or online banking. Enter the payment details accurately and ensure sufficient funds in the chosen account.

Tip 5: Complete Payment and Receive Receipt: Once the payment is processed successfully, you will receive an electronic receipt or confirmation message. Keep a copy of this document for your records and as proof of payment.

Tip 6: Update Registration: After completing the online payment, visit the relevant authority or vehicle registration office to update your vehicle registration details and obtain the updated certificate or sticker.

Tip 7: Stay Informed: Regularly check for updates and announcements from the government regarding changes in road tax rates, payment deadlines, or online payment procedures.

By following these tips, you can streamline the vehicle registration and tax management process, ensuring timely payments, accurate documentation, and compliance with regulations.

Pay Your Road Tax Online For Seamless Vehicle Registration And Tax Management

Efficient vehicle registration and tax management are crucial for vehicle owners. Paying road tax online offers several key advantages, enhancing convenience and accuracy. Let's explore these essential aspects:

- Convenience: Online payment eliminates the need for physical visits and queues.

- Efficiency: Automated systems process payments and update records instantly.

- Accuracy: Online platforms reduce errors and ensure accurate tax calculations.

- Transparency: Online portals provide clear records of payments and receipts.

- Time-saving: Simplifies the process, freeing up time for other tasks.

- Flexibility: Allows payments to be made at any convenient time or location.

These aspects collectively make online road tax payment a valuable tool. By embracing these advantages, vehicle owners can streamline their administrative tasks and enjoy a hassle-free vehicle registration and tax management experience.

Uttar Pradesh Road Tax Payment for Vehicle Online | Road Tax in UP - Source www.uptransport.co.in

Malaysian Privately-Owned Vehicles Won’t Have To Display Their Road Tax - Source sea.mashable.com

Pay Your Road Tax Online For Seamless Vehicle Registration And Tax Management

Optimizing the process of vehicle registration and tax management through online road tax payment systems fosters several interconnected benefits. It simplifies and streamlines the payment process, eliminating the need for physical visits to government offices and long queues. This convenience enhances citizen satisfaction and promotes efficient use of time. Moreover, online payment platforms provide secure and transparent transaction environments, minimizing the risk of errors and fraud. By integrating with vehicle registration databases, these systems ensure timely updates and accurate record-keeping, improving the overall efficiency of vehicle administration.

Road Tax For Electric Cars Malaysia - Ricca Cinderella - Source rosbdemetra.pages.dev

The ability to pay road tax online also promotes responsible vehicle ownership by encouraging timely payments. Automated reminders and notifications can be set up to prevent late payments and potential penalties. This enhances compliance with regulations and generates a consistent revenue stream for road maintenance and infrastructure development. Additionally, online platforms often provide comprehensive tax information and personalized payment plans, empowering citizens to make informed decisions regarding their vehicle-related expenses.

From a broader perspective, seamless vehicle registration and tax management contribute to sustainable urban development. Efficient transportation systems, supported by properly maintained roads and infrastructure, reduce traffic congestion and emissions. By streamlining vehicle administration processes, cities can allocate resources more effectively, prioritize public transportation, and implement smart traffic management solutions. Ultimately, the convenience, transparency, and efficiency of online road tax payment systems play a transformative role in creating a more organized, sustainable, and citizen-centric approach to vehicle ownership and transportation management.

Conclusion

Ensuring seamless vehicle registration and tax management through online road tax payment systems is an essential step toward modernizing citizen services and improving transportation governance. The convenience, transparency, and efficiency of these platforms empower citizens, streamline administrative processes, and contribute to sustainable urban development.

As cities continue to grow and transportation demands evolve, the adoption of innovative and citizen-centric solutions will be crucial. By embracing online road tax payment systems, cities can enhance their vehicle administration capabilities, optimize resource allocation, and ultimately create a more sustainable and livable environment for all.