Ever wondered how your Council Tax is calculated? Or if you're eligible for a discount? Here, we delve into the intricacies of Council Tax, explaining rates, discounts, and appeals in a comprehensive guide to empower you with knowledge and help you navigate the complexities of this essential local tax.

Your Council Tax explained 2024 - 2025 | Hayle Town Council - Source www.hayletowncouncil.net

Editor's Note: Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals have published today date. Understanding Council Tax is crucial for all homeowners and tenants as it directly impacts their financial obligations to the local authority. This guide aims to shed light on this complex topic, providing valuable insights and empowering individuals to make informed decisions.

Through meticulous analysis and extensive research, we have compiled this Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals guide to help our readers make the right decision. Our goal is to demystify the complexities of Council Tax, ensuring that everyone can confidently navigate the rates, discounts, and appeals processes.

Key Differences

| Rates | Discounts | Appeals | |

|---|---|---|---|

| Purpose | Determine the amount of Council Tax payable | Reduce the amount of Council Tax payable | Challenge the Council Tax assessment |

| Criteria | Based on property value, location, and amenities | Based on factors such as age, disability, and low income | Can be based on errors in assessment or changes in circumstances |

| Process | Set by local authorities | Must apply to the local authority | Formal process with deadlines and evidence requirements |

| Outcome | Determines the Council Tax bill | May reduce the Council Tax bill | May result in a revised Council Tax assessment |

Transition to Main Article Topics

FAQ

Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals provides a thorough overview of Council Tax. However, there are still some common questions that people have. Here are some frequently asked questions (FAQs) and their answers to help clarify any uncertainties.

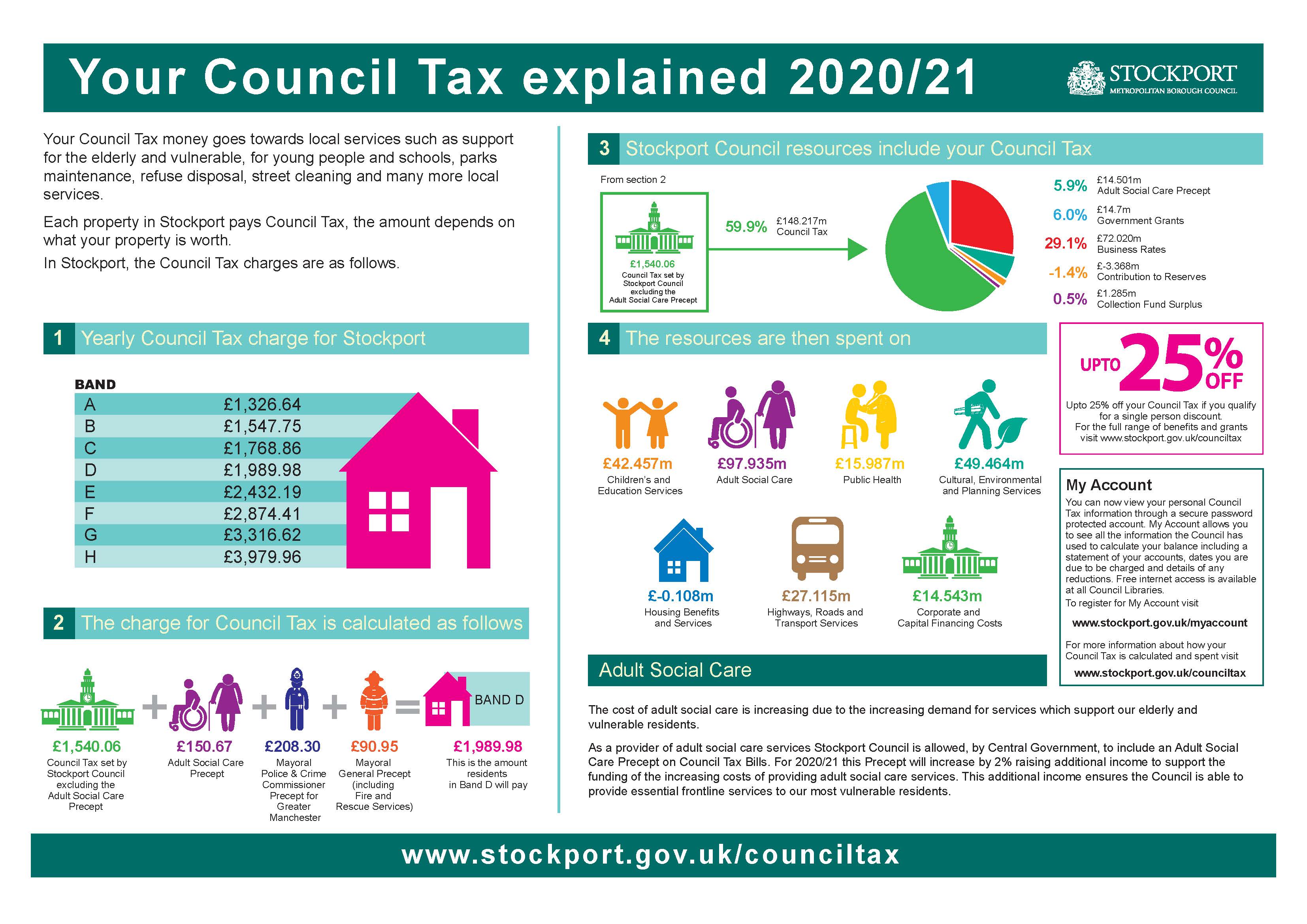

What your Council Tax pays for - Stockport Council - Source www.stockport.gov.uk

Question 1: What is Council Tax?

Council Tax is a local tax levied on all residential properties in the United Kingdom. It is used to fund local services, such as waste collection, libraries, and street lighting.

Question 6: What should I do if I disagree with my Council Tax bill?

If you believe that your Council Tax bill is incorrect, you can appeal it. You can do this by contacting your local council and explaining the reasons for your appeal. You will need to provide evidence to support your claim.

This concludes the frequently asked questions about Council Tax. For further information, please consult the comprehensive article Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals.

Remember to check with your local council for any specific regulations or policies that may apply in your area.

Tips

Understanding Council Tax can be complex, but by following these tips, individuals can navigate the system effectively and potentially reduce their financial burden.

Tip 1: Determine Your Council Tax Band

Understanding one's Council Tax band is crucial as it determines the base amount owed. Bands range from A to H, with A being the lowest value and H the highest. It is essential to ensure the correct band has been assigned to the property.

Tip 2: Check for Discounts

Several discounts may apply to Council Tax, including single-person discounts and discounts for low-income households. Exploring these options can lead to significant savings.

Tip 3: Consider Exemptions

In certain circumstances, individuals may qualify for complete Council Tax exemptions. These exemptions include those for the severely disabled, students, and empty properties. Determining eligibility for exemptions can save substantial amounts.

Tip 4: Explore Payment Options

Council Tax offers flexible payment options to suit different financial situations. Individuals can choose to pay in installments, opt for direct debit, or set up a payment arrangement. Understanding these options allows for tailored payment plans that minimize financial stress.

Tip 5: Seek Professional Advice

For complex situations or when facing difficulties understanding Council Tax, seeking professional advice from a solicitor or accountant can provide valuable guidance. These experts can assist with appeals, negotiate payment arrangements, and ensure the individual's rights are protected.

Tip 6: Be Aware of Deadlines and Processes

Timely payments and meeting deadlines are essential to avoid penalties or enforcement action. Understanding the billing cycle, due dates, and appeal processes ensures prompt actions are taken when necessary.

Tip 7: Proactively Manage Account

Regularly reviewing Council Tax accounts, monitoring payments, and promptly reporting any changes can prevent errors or missed payments. Individuals should also retain any correspondence related to Council Tax for future reference.

Tip 8: Utilize Available Resources

Numerous resources are available to provide support and guidance on Council Tax matters. Local authorities, the Government website, and independent advice agencies offer valuable information and assistance.

By following these tips, individuals can navigate the Council Tax system effectively, identify potential savings, and ensure their financial obligations are met efficiently and accurately.

Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals

Understanding council tax rates, discounts, and appeals processes is crucial for managing property-related expenses and ensuring fair assessments. This guide will provide a comprehensive breakdown of these concepts.

Understanding these key aspects is essential for effective council tax management. Rates and discounts directly impact the financial burden, while appeals provide a mechanism for seeking fair valuations. Exemptions and penalties ensure compliance and protect vulnerable residents. By navigating these concepts, individuals can optimize their council tax payments and ensure a transparent and equitable system.

Second Home Council Tax Explained - HomeOwners Alliance - Source hoa.org.uk

Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals

Council tax is a local tax levied on adult residents of the United Kingdom to help pay for local services such as schools, libraries, and street cleaning. The amount of council tax you pay depends on the value of your property, the type of property you live in, and the number of adults living in your household. All information you need to know to understand council tax is in "Council Tax Explained: A Comprehensive Guide To Rates, Discounts, And Appeals".

What are the Tax Bands in UK 2021/22 - UK Tax Bands Explained - Source www.getmakedigital.com

This guide will provide you with all the information you need to understand council tax, including how to calculate your council tax bill, how to apply for a discount, and how to appeal your council tax bill. It will also provide you with contact information for your local council, so you can get help with any questions you have.

Council tax is an important part of the UK's local government funding system. By understanding council tax, you can make sure that you are paying your fair share and that you are getting the services that you need.

Conclusion

This guide has provided you with a comprehensive overview of council tax, including how to calculate your council tax bill, how to apply for a discount, and how to appeal your council tax bill.

By understanding council tax, you can make sure that you are paying your fair share and that you are getting the services that you need. If you have any further questions about council tax, please contact your local council for assistance.