Are you wondering about the 2025 pension changes and how they might affect your financial future? Look no further than "2025 Pension Changes: A Comprehensive Guide For Informed Financial Planning," your ultimate resource for understanding these critical alterations.

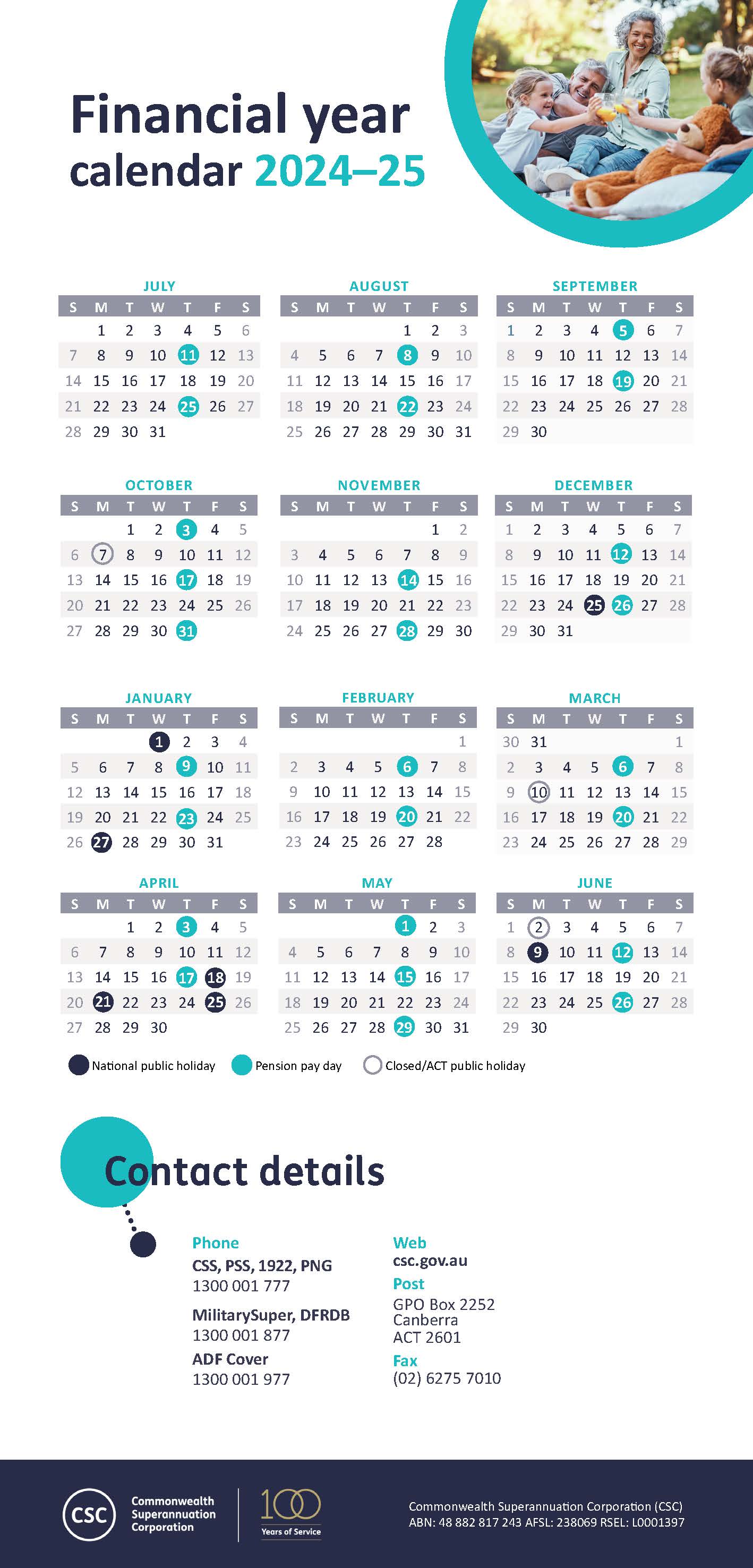

Understanding the 2025 Pension Payment Calendar: A Comprehensive Guide - Source gadingku88.com

Editor's Note: “2025 Pension Changes: A Comprehensive Guide For Informed Financial Planning” was published on [Date] to provide timely guidance on this crucial topic, empowering individuals to make informed decisions about their pension plans.

Through meticulous analysis and expert insights, we've compiled this comprehensive guide to help you navigate the complexities of the 2025 pension changes and plan your financial future with confidence.

Key Differences: 2023 vs 2025 Pension Changes

| 2023 Pension Changes | 2025 Pension Changes |

|---|---|

| Increased contribution limits for defined contribution plans | Assumption of a lower rate of return on investments |

| Expansion of catch-up contributions | Mandatory use of mortality tables for calculating life expectancies |

| New rules for in-service withdrawals | Higher minimum distribution ages |

Our in-depth guide delves into these changes and their implications for your retirement savings, helping you:

FAQ

This article offers a comprehensive overview of the 2025 pension changes, but there may still be specific questions or concerns that require further clarification. To address some of the most common inquiries, we have compiled a list of frequently asked questions (FAQs) to provide additional guidance.

12 Internal and External Factors Influencing Financial Decision - Source www.iedunote.com

Question 1: What are the key changes to pension rules taking effect in 2025?

Answer: The 2025 pension changes primarily focus on increasing the age at which individuals can access their pension savings. The State Pension age will gradually rise to 68 by 2046, and the age at which one can access private pensions will also be raised. These changes aim to ensure the sustainability of pension schemes in the face of increasing life expectancy and a growing number of pensioners.

Question 2: How will the changes affect my current pension arrangements?

Answer: The impact of the changes will vary depending on your individual circumstances and the type of pension you hold. It is essential to check with your pension provider to understand how the revised rules will affect your specific arrangements and explore any available options for mitigating the potential financial implications.

Question 3: What are the potential financial implications of the pension changes?

Answer: Delaying access to pension savings may have financial implications, such as the need to work longer or reduce expenditure in retirement. However, the changes also provide opportunities for individuals to contribute more to their pensions and potentially increase their retirement income in the long run.

Question 4: Can I opt out of the new pension rules?

Answer: Opting out of the State Pension is not allowed. However, you may have the option to adjust your private pension arrangements, such as delaying retirement or increasing contributions, to offset the impact of the changes.

Question 5: What steps can I take to prepare for the 2025 pension changes?

Answer: The most effective way to prepare is to seek professional financial advice. A qualified advisor can assess your individual circumstances, review your existing pension arrangements, and guide you in making informed decisions to mitigate any potential financial impact of the changes.

Question 6: Where can I find additional information or resources on the 2025 pension changes?

Answer: You can refer to the comprehensive guide on 2025 pension changes here for more detailed information and guidance. Additionally, government websites and reputable financial institutions often provide valuable resources and updates on the latest pension regulations.

It is important to remember that the 2025 pension changes are part of an ongoing effort to ensure the long-term sustainability of the pension system. While the adjustments may have short-term implications, they aim to provide greater financial security and stability for individuals in retirement.

Tips

In anticipation of 2025 pension changes, proactive planning is critical for secure financial futures. Consider these prudent tips to optimize retirement savings and mitigate potential risks.

Tip 1: Explore Available Savings Options

Supplement the new pension scheme with additional savings vehicles such as personal pensions or ISAs to enhance retirement income and reduce the financial impact of reduced pension benefits.

Tip 2: Maximize Employer Contributions

Fully utilize employer pension matching programs to maximize contributions and accumulate larger retirement savings.

Tip 3: Seek Professional Financial Advice

Consult with a qualified financial advisor to develop a tailored financial plan that considers the 2025 pension changes, individual circumstances, and long-term retirement goals.

Tip 4: Focus on Salary Growth

Negotiate salary increases to mitigate the effects of reduced pension benefits. Higher earnings translate to increased pension contributions and potential future benefits.

Tip 5: Delay Retirement

Working additional years beyond the traditional retirement age can increase pension benefits by accruing more contributions and earning potential cost-of-living adjustments.

Tip 6: Consider Part-Time Employment

For those nearing retirement, part-time employment can provide additional income while gradually transitioning to full retirement.

Tip 7: Review Pension Statements Regularly

Monitor pension statements diligently to track progress, identify any discrepancies, and adjust contributions or retirement plans as necessary.

Tip 8: Understand the State Pension Changes

Research and stay informed about the specific changes to the state pension to make informed decisions regarding retirement planning and financial security.

By implementing these tips, individuals can proactively prepare for the 2025 pension changes, secure their financial well-being, and achieve their desired retirement lifestyle.

2025 Pension Changes: A Comprehensive Guide For Informed Financial Planning

The 2025 pension changes will bring about significant alterations in the UK pension system. To ensure informed financial planning, it is crucial to understand the key aspects of these changes:

- Contribution Limits: Increased limits on pension contributions.

- Age Thresholds: Changes to the age at which individuals can access and draw down their pensions.

- Taxation: New rules and regulations regarding pension withdrawals and tax implications.

- State Pension: Revisions to the State Pension age and calculations.

- Retirement Flexibility: Enhanced options for accessing pension funds and managing retirement income.

- Investment Options: Broader investment options within pension schemes, providing greater flexibility.

These aspects collectively impact financial planning strategies. Understanding the implications of these changes can help individuals make informed decisions about their retirement savings, ensuring financial security in their later years.

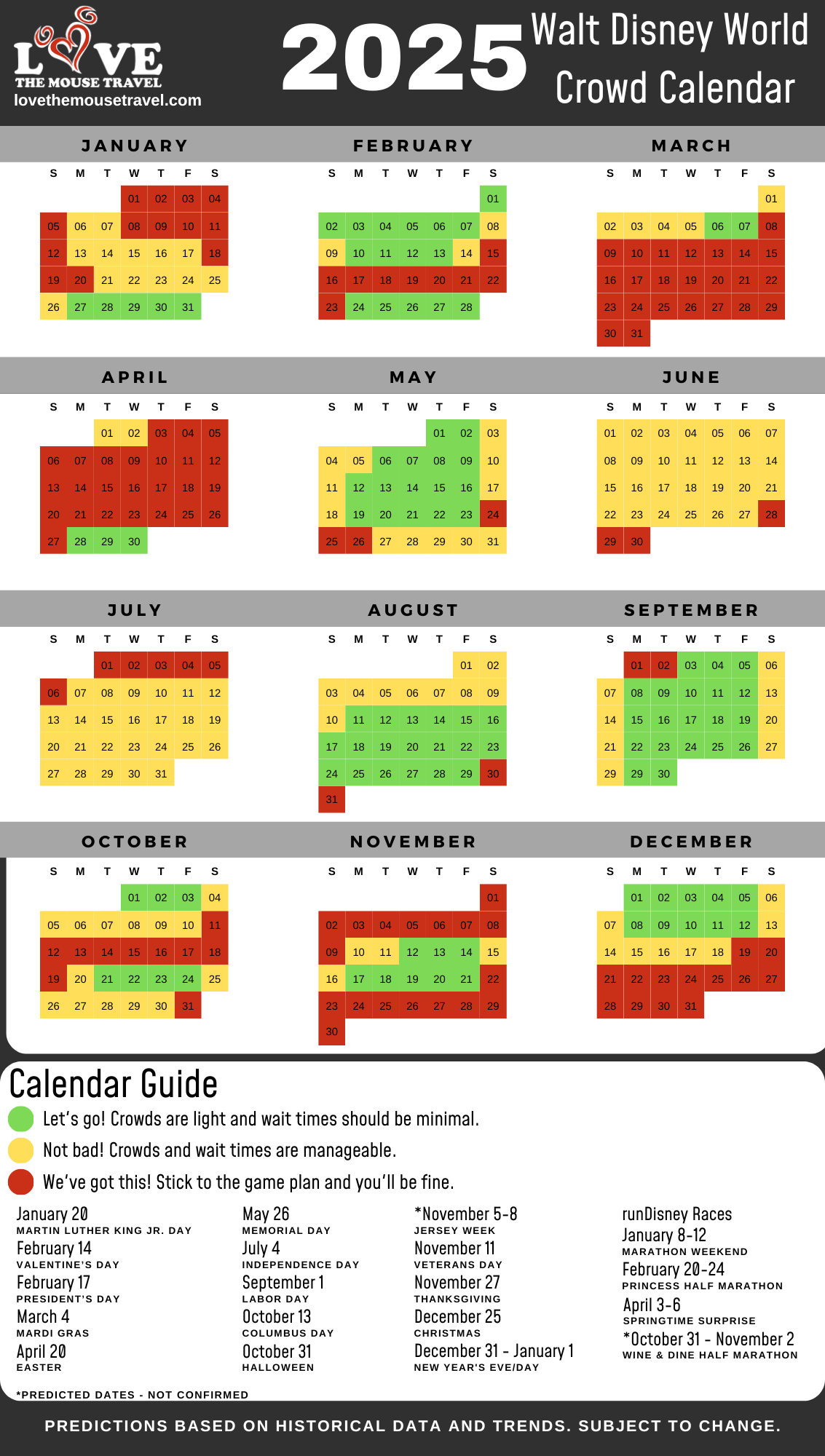

Disney World Crowd Calendar 2025: A Comprehensive Guide To Planning - Source 2025weeklymonthlyplanner.pages.dev

2025 Pension Changes: A Comprehensive Guide For Informed Financial Planning

The year 2025 marks a significant turning point in the landscape of pension planning, with a raft of changes set to come into effect that will have a profound impact on retirement savings and financial security. Understanding these changes is essential for informed decision-making and effective financial planning.

July 2023 Age Pension changes - Source retirementessentials.com.au

One key aspect of the 2025 pension changes is the increase in the State Pension age. From April 2025, the State Pension age will rise to 67 for both men and women, bringing it in line with the age at which most people can access their private pensions. This means that individuals will need to work for longer to qualify for a full State Pension, or face a potential reduction in their pension income if they choose to retire earlier.

Another significant change is the introduction of a new tapered annual allowance for pension contributions. This allowance will gradually reduce the amount of tax relief that higher earners can claim on their pension contributions, potentially affecting those who are on track to exceed the lifetime allowance for pension savings. As a result, individuals may need to adjust their pension planning strategies to minimize the impact of this change.

The 2025 pension changes also include the abolition of the "triple lock" on State Pension increases. Previously, the State Pension was required to increase by the highest of inflation, average earnings, or 2.5%. Under the new rules, the State Pension will increase by the higher of inflation or average earnings, potentially leading to more modest increases in pension income over time.

These changes underscore the importance of proactive financial planning to ensure a secure retirement. By understanding the implications of the 2025 pension changes, individuals can make informed decisions about their savings, investments, and retirement goals. It is advisable to consult with a qualified financial advisor to develop a personalized financial plan that takes into account these changes and ensures a comfortable and financially secure retirement.

Conclusion

The 2025 pension changes represent a significant shift in the landscape of retirement planning, with far-reaching implications for individuals' financial well-being. The increase in the State Pension age, the introduction of a tapered annual allowance, and the abolition of the triple lock on State Pension increases necessitate a proactive approach to financial planning.

By understanding these changes and seeking professional advice, individuals can make informed decisions about their savings, investments, and retirement goals. This will help them navigate the evolving pension landscape and ensure a secure and financially fulfilling retirement.